Intraday share trading, or day trading, offers the potential for quick profits in the stock market. However, amidst the excitement of rapid trades and market fluctuations, understanding the tax implications is crucial. This blog aims to demystify the complexities of taxation in day trading, ensuring you can navigate this aspect with confidence and optimize your financial outcomes.

Note – This is a dynamic content and will be updated from time to time for the applicable amendments. Any corrections or suggestions or inputs or support are welcome from the reader either by filing the form at the end of this wonderful post or through the mail at hello@fiscalnow.com.

What is Intraday Share Trading?

Intraday share trading, also known as day trading, refers to the practice of buying and selling of the same particular stock within the same trading day. The same may result either in profit or loss to the trader, apart from certain charges for the intraday trade like Brokerage, STT, & other levies.

How Intraday Share Trading is Taxed as per the Indian Income Tax Act 1961?

The activity of Intraday Share Trading is considered to be the Speculative Business Activity, therefore the resultant profit or loss shall be reported as speculative profits or speculative loss as the case may be.

Which ITR Form is applicable for Intraday Share Trading Income (Profit / Loss)?

If a taxpayer engaged in Intraday Share Trading, then none of the following forms are not at applicable irrespective of any other factors like type of Income, Legal Status etc.:

- ITR 1

- ITR 2

- ITR 4

Instead, one of the the following forms will get applicable based on other factors like type of Income, Legal Status etc.:

- ITR 3

- ITR 5

- ITR 6

- ITR 7

Where, in an ITR Form, the Income (Profit / Loss) from Intraday Share Trading shall be reported?

The same shall be reported in the “Part A – Trading Account” of an applicable ITR Form, the same asks for two informations as follows:

- Turnover from Intraday Trading

- Income from Intraday Trading – transferred to Profit and Loss account

How Turnover from Intraday Share Trading is Calculated?

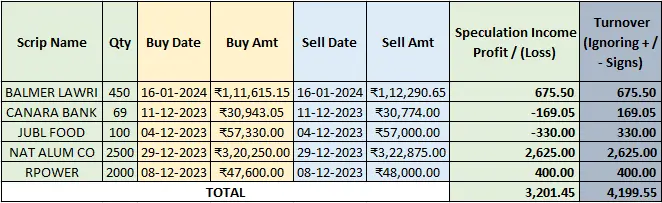

The Turnover is calculated by adding all the profits and losses, by ignoring all the plus (+) and minus (-) signs. In other words, the total of favorable and unfavorable differences shall be taken as turnover (ignoring the symbols whether profit (plus) or loss(minus)). The above methodology is not prescribed in any of the provision of the Income Tax Act 1961 or appended rules or circulars or notifications, however, the same is provided in Guidance Note issued by the Institute of Chartered Accountants of India (ICAI) for the purpose of tax audit under section 44AB. Turnover calculation in case of Intraday Share Trading can be better understood with the help of following example:

Observations

- In case a person did not make any loss or all trades were in profits, then the speculation Income will be profit equivalent to the Turnover. If in the above table we treat the losses as profits then the Speculative Income and Turnover will both be equivalent to Rs. 4,199.55.

- In case a person did not make any profits or all trades were in loss, then the speculation Income will be loss equivalent to the Turnover. If in the above table we treat all the profits as losses then the Speculative Income would be minus (-) Rs. 4,199.55 and Turnover would have been Rs. 4,199.55.

- In case a person earned more profits and suffered losses less than profits, then the Turnover will be greater than Speculative Income (profits) .

- In case a person earned less profits and suffered losses more than profits, then Speculative Income will be negative (i.e., loss) and less than the Turnover.

How Speculative Income (Profit / (Loss)) from Intraday Share Trading is Calculated?

The Speculative Income which is to be reported here shall be net of the following levies:

- SEBI Fees

- Brokerage

- Turnover Charges

- Demat Transaction Charges

- Gst

- IPFT Charges

- Securities Transaction Tax (STT)

- Stamp Duty

- Any Other Levy as applicable from time to time

Therefore, the above mentioned expenses, proportional to the speculative trades shall also be reduced from the Speculative Income.

Adherence shall be given while deducting above listed expenses as certain brokers in the capital gain / tax reports or tax p&l reports the net figure i.e., after reducing the above listed expenditure, whereas, certain brokers report the gross speculative income and separately provide for above listed expenditures

Caution! Do the Calculations Carefully..

As described above a lot of care needs to be taken while preparing ITRs with Speculative Income from Intraday Share Trading, therefore, instead of doing all the math yourself, choose fiscalnow’s ITR Filing Service which lets you relax and enable ITR filing at super affordable prices.